Do I Really Need a 20 Percent Down Payment for a House?

Eric J. Martin

Eager to purchase a home? You’ll likely need to save up for a down payment. This represents the initial portion of a home’s purchase price, and you pay it upfront, so it’s not part of the amount financed through your mortgage loan.

That begs the question, how much of a down payment do you actually need? Conventional wisdom says that 20 percent of the home’s price is standard. This is daunting for many people, and with good reason: On a $350,000 home, 20 percent is $70,000 — a huge sum to have to pay all at once.

But don’t let that number keep you from your homeownership dreams. The truth is, it’s possible to buy a house with a much lower down payment, or even none at all if you qualify. Read on to learn more.

Do You Have To Put 20 Percent Down on a House?

The down payment you make on a home represents a percentage of its purchase price, so the amount you need depends largely on the price of the home you’re buying. The more expensive the home, the more money you’ll need for a down payment.

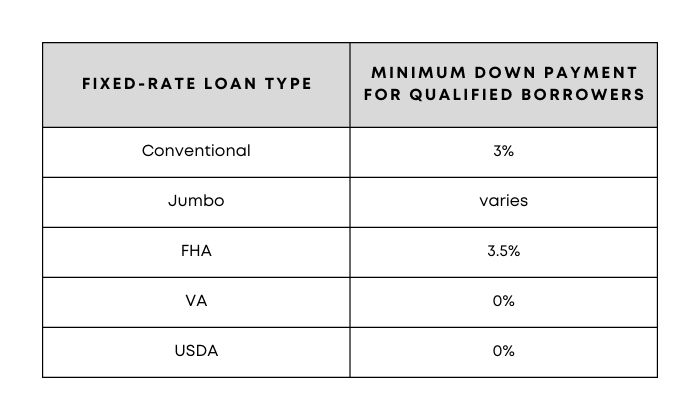

But a lot also depends on the type of mortgage you choose. A 20 percent down payment may be traditional, but it’s not mandatory — in fact, according to 2023 data from the National Association of Realtors, the median down payment for U.S. homebuyers was 14 percent of the purchase price, not 20. Conventional loans can require as little as 3 percent down for qualified borrowers, while FHA loans can be had for as low as 3.5 percent if you meet the credit requirements.

Regardless of price or loan type, though, keep in mind that the more money you put down upfront, the less you will have to borrow. Borrowing less equates to lower monthly payments, and less interest paid over the life of the loan. So no matter what your loan requires as a minimum, it’s in your best interest to make as large of a down payment as you can afford.

Minimum Down Payment Requirements

Most of these minimums require you to meet some level of eligibility standards in order to qualify. For example, FHA loans at 3.5 percent are only available to those with credit scores of 580 or above. VA loan borrowers must meet requirements set forth by the Department of Veterans Affairs. And for a USDA loan, you must buy a rural property that meets specific criteria.

Private Mortgage Insurance

Private mortgage insurance, often abbreviated as PMI, is another reason to opt for a 20 percent down payment if at all possible. If more than 80 percent of a property’s cost is being financed, most conventional lenders will charge this additional fee every month as a safeguard against default. In other words, if you put down less than 20 percent, it will add a bit more to your monthly payments in the form of PMI. The exact amount depends on how much you did put down and what your interest rate is.

Fortunately, PMI will not usually extend for the entire life of a conventional loan. Once you’ve accumulated 20 percent equity in your home, either through gradually paying down your balance or due to an increase in home values, it can be removed. (If this does not happen automatically, contact your lender to discuss it.)

Note that FHA loans have their own slightly different version of mortgage insurance, which entails an initial payment and ongoing annual mortgage insurance premiums.

Down Payment Assistance

If you’re finding it challenging to save up enough cash for a down payment, help is available. The federal government, and most state and local governments too, offer various down payment assistance programs designed to help people achieve homeownership. If you qualify, these can help you cover down payment and/or closing costs, typically in the form of grants and low-interest, deferred-payment or forgivable loans. Eligibility requirements and availability vary from one program to the next. Here are some good places to start looking:

- At the federal level: The U.S. Department of Housing and Urban Development’s website lists local homebuying programs by state.

- At the state level: Many states’ Housing Finance Agencies provide homebuying aid and education.

- At the local level: Plenty of cities and counties offer down payment assistance programs, too, especially for first-time purchasers. Check your municipality’s website for details, or try searching at Down Payment Resource.

20 Percent vs. Smaller Down Payment

If you put down at least 20 percent on your home purchase, you’ll see several benefits:

- Saving money: “With a larger down payment, your monthly mortgage payment will be lower, and you may qualify for better rates or terms,” says Diane Hughes, executive vice president and director of mortgage lending at UMB Bank in Kansas City, Missouri.

- Financial stability: A larger down payment makes lenders see you more favorably and demonstrates financial stability, which can improve the chances of loan approval. It also gives you more stability once you own the home: “When you put more money down, you have more cushion to withstand market fluctuations and their impact on the value of your home,” says Ashley Moore, community lending manager for JPMorgan Chase in Houston.

- No PMI: A 20 percent down payment means you won’t have to pay for private mortgage insurance.

While a smaller down payment saves you money upfront, it has serious long-term drawbacks:

- A bigger loan: Putting down less upfront means borrowing more to make the purchase, which makes for higher monthly payments and more interest paid over time.

- Higher costs: Your mortgage interest rate and loan costs could be higher if you put down less upfront. “It can increase the cost to the borrower when you put less than 20 percent down, as many loans are priced based on factors relating to risk,” says Scott Griffin, founder of Scott Griffin Financial in Los Angeles.

- PMI: You will likely be required to pay for PMI, which adds to your monthly payments.

Is It Ever Smart To Put Down Less Than 20 Percent?

For most homebuyers, a down payment of less than 20 percent will generally cost more money in the long run. But if saving up that kind of money will keep you from ever owning a home, it’s worth considering.

“Putting down less than 20 percent on your home may be a good idea if you have a good household income but haven’t had time to save up for a down payment,” Moore says. “It can also be a good idea if a large down payment will almost completely deplete your savings, or if it is the only thing preventing you from buying a home.”

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link